Swapitor is the gateway to investment enlightenment. It aims to enhance understanding of investments by seemingly connecting individuals with educational resources. Dedicated to empowering users by bridging them to financial education providers, Swapitor invites people to begin an investment education, unraveling the complexities of finance.

At Swapitor, it's all about access to investment education. Matching individuals with tutors who offer personalized lessons, catering to all experience levels, from beginners to seasoned investors. Swapitor ensures everyone finds a suitable match to enhance their financial understanding and pursue their goals.

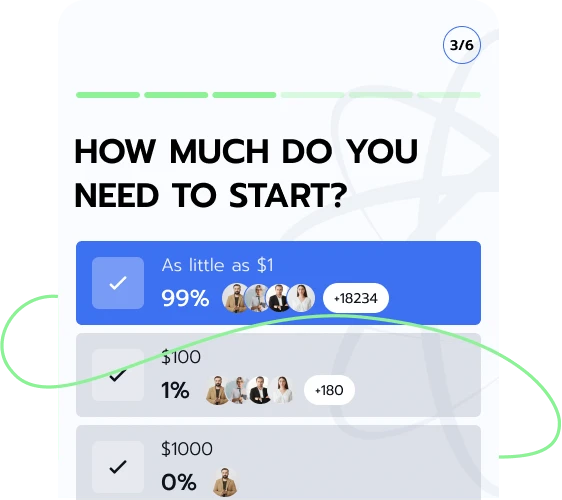

The investment education firms partnered with Swapitor offer users crucial knowledge for an informed investment path. Additionally, registering on Swapitor is free, ensuring everyone can kickstart their investment education without financial barriers holding them back.

At Swapitor, once individuals sign up, they're on their way to investment enlightenment. A friendly representative from an investment education firm will reach out to kickstart their learning adventure. Swapitor links users with knowledgeable tutors who are ready to tackle their questions and assist them every step of the way on their educational journey.

Ready to get started with Swapitor? Fill out the registration form precisely; one is set to embark on the investment journey.

Upon registration on Swapitor, individuals are promptly paired with an investment education firm.

The investment education firm's representative proactively contacts new users, offering assistance and reassurance. With a focus on clarity and support, they aim to ease any uncertainties and provide insights, ensuring a seamless transition into learning.

Additionally, the representative will inquire about the user's background to customize the learning journey based on their preferences and experience level. This personalized approach ensures an engaging educational experience tailored to each individual's needs.

At Swapitor, connecting eager learners with investment education firms is the order of the day. As the ultimate matchmaker, Swapitor opens the doors to investment education, making it accessible for aspiring learners everywhere.

For novices and seasoned investors, Swapitor bridges the gap to personalized investment education providers. As the facilitator, the website sets the stage for a tailored learning journey determined by the investment education provider, ensuring an enriching experience for all.

Upon joining Swapitor, users gain access to the investment education firm's website, empowering them to learn on their schedule. With flexibility, users can begin their education at their own pace and convenience.

Experience a seamless journey as individuals swiftly connect with investment education firms through Swapitor's hassle-free registration process. Enjoy complimentary services across the board, making access to investment education easy.

Upon registration on Swapitor, individuals are promptly connected with an education firm's representative who provides personalized assistance, enhancing their educational journey. Enjoy tailored assistance in the learning experience from the get-go.

Market analysis is a crucial component of investment education that involves studying various aspects of financial markets to make informed investment decisions. It encompasses multiple techniques and methods to understand market trends, investor sentiment, and economic indicators. Here are some of the critical aspects of market analysis:

This involves studying the broader economic factors that can influence financial markets. Analysts examine indicators such as GDP growth, inflation rates, employment data, and central bank policies to gauge the overall health of the economy and its possible impact on asset prices.

Technical analysis studies past market data, primarily price and volume, to identify patterns and trends that may help predict future price movements. Swapitor’s connection helps users access various tools and indicators analysts use. These include moving averages, trend lines, and chart patterns to identify possible entry and exit points for trades.

Fundamental Analysis

This involves evaluating the intrinsic value of an asset by analyzing its underlying factors, such as financial statements, earnings, growth prospects, and industry trends. Analysts assess factors like earnings per share (EPS), price-to-earnings (P/E) ratio, and return on investment (ROI) to determine whether an asset is undervalued or overvalued.

Sentiment Analysis

Sentiment analysis involves assessing the mood and sentiment of market participants, including investors, traders, and analysts. Analysts may use surveys, social media sentiment analysis, and market sentiment indicators to gauge market sentiment and identify possible market turning points.

Sector and Industry Analysis

Analysts also analyze specific sectors and industries within the market to identify emerging trends, possible opportunities, and risks. They examine competitive dynamics, regulatory environment, technological advancements, and consumer behavior.

At Swapitor, users gain access to firms that provide illuminating education on sector and industry analysis, empowering users to make informed financial decisions.

Risk analysis is another investment aspect Swapitor connects users to tutors to learn about. It involves assessing the various risks associated with investing in financial markets, including market, credit, liquidity, and geopolitical risks. Analysts use risk management techniques, such as diversification, hedging, and position sizing, to try and mitigate these risks to protect investment capital.

Understanding asset classes is fundamental in investment education as it provides individuals with the knowledge to construct diversified investment portfolios tailored to their financial goals, risk tolerance, and time horizon. Asset classes represent different categories of investments with distinct characteristics and risk-return profiles. The main asset classes typically include equities (stocks), fixed income (bonds), cash equivalents, and alternative investments (such as real estate, commodities, and private equity).

Each asset class offers unique pros and drawbacks, and investors allocate their capital across multiple asset classes to try and balance risk and return. In investment education, individuals learn about each asset class's characteristics and key features to make informed investment decisions.

They study the historical performance, risk factors, and correlations between asset classes to understand how they behave under different market conditions. For example, equities are known for their possible high returns but come with higher volatility and risk than fixed-income securities. On the other hand, fixed-income investments may provide regular income streams and lower volatility but may offer lower returns over the long term and are susceptible to credit risks.

Understanding the regulatory environment is vital in investment education as it provides insights into the rules, regulations, and laws that govern financial markets.

With a knowledge of finance regulations, individuals may ethically navigate financial market complexities. They can adhere to applicable laws and regulations, uphold high standards of governance and transparency, and make informed investment decisions that may protect investor interests and promote market integrity. Here are some of the critical aspects of the regulatory environment:

Investment education covers the fundamental principles of securities laws and regulations that govern securities issuance, trading, and disclosure. These laws are designed to protect investors and may ensure the integrity and transparency of financial markets.

Investment education familiarizes individuals with the roles and responsibilities of regulatory agencies overseeing financial markets. These agencies include the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the European Securities and Markets Authority (ESMA) in the European Union.

Investment education emphasizes the importance of compliance with regulatory requirements and corporate governance standards. Individuals learn about practices for compliance, including conducting due diligence and maintaining accurate records.

Investment education sheds light on market integrity and transparency principles, essential for maintaining investor confidence and market efficiency. Students learn about regulations governing insider trading, market manipulation, and material information disclosure to try and prevent fraud and enhance market fairness.

Within investment education, individuals are familiarized with stress testing and scenario analysis as essential tools to gauge the robustness of their investment portfolios in the face of adverse market conditions. By envisioning diverse hypothetical scenarios – from market crashes and economic recessions to geopolitical crises – investors may meticulously evaluate the repercussions on their portfolios and pinpoint areas of vulnerability.

This proactive methodology enables them to fine-tune their risk management strategies and portfolio allocations, fortifying their defenses against certain unforeseen events and managing risks. Register on Swapitor to gain access to investment education companies that provide suitable knowledge.

Swapitor's affiliated investment education providers unveil the fascinating interplay between human psychology and financial decision-making. Delving deep into the psyche, individuals unearth the common pitfalls lurking within the mind, from the siren call of overconfidence to the paralyzing grip of loss aversion and the irresistible allure of herd mentality.

Armed with this illuminating insight, individuals can seek to tame their inner biases, grasping the art of rationality and discipline in their investment pursuits. As the veil of cognitive biases is lifted, investors may emerge enlightened and empowered to navigate the turbulent waters of financial markets with clarity and purpose. With investment education companies accessible through Swapitor, learners can use the knowledge of behavioral finance to improve their investment skills.

With a steadfast resolve to defy the gravitational pull of emotionally driven decision-making, individuals chart a course guided by objectivity.

Risk management is a critical aspect of investment education that involves identifying, assessing, and mitigating the various risks associated with investing in financial markets. Swapitor links interested people with investment education providers who expose them to the knowledge of risk management. Here are some of the critical aspects of risk management:

The first step in risk management is identifying the possible risks that could impact investment portfolios. These risks can vary widely and may include market, credit, liquidity, inflation, etc. Swapitor connects interested persons with investment educators to learn about these risks.

Once risks are identified, investment education focuses on assessing the likelihood and severity of each risk. It involves analyzing historical data, economic indicators, financial statements, and other relevant information to quantify the probability of adverse events occurring and their possible magnitude. Swapitor-affiliated investment educators offer educational resources on risk assessment.

Investment education equips individuals with various risk mitigation strategies to manage and try and minimize the impact of identified risks on investment portfolios. These strategies may include diversification, asset allocation, hedging, portfolio rebalancing, and derivative instruments such as options and futures contracts.

Risk management is an ongoing process that requires continuous monitoring and adjustment as market conditions change and new risks emerge. Swapitor helps access educational providers that explain monitoring risks.

Risk management in investment also involves clear communication and reporting of risks to stakeholders, including investors, clients, and regulatory authorities.

Lastly, investment education may cover regulatory compliance and legal considerations related to risk management in financial markets. Swapitor affiliates educate students to recognize common cognitive biases that may impact their investment decisions.

In the dynamic world of investment, the quest for knowledge is paramount, driving individuals to seek investment education. Swapitor is the beacon leading enthusiasts to education firms offering customized solutions.

Through strategic alliances, Swapitor equips users with insights, empowering them to navigate the fluidity of the investment realm. Best of all, registration with Swapitor comes at no cost, opening doors to opportunities for development.